Medical & Allied Health Services Guide

Murfett Legal is a long established and award-winning law firm which provides a comprehensive range of legal and advisory services to medical practitioners and allied health services providers (Medical Providers).

STRUCTURE

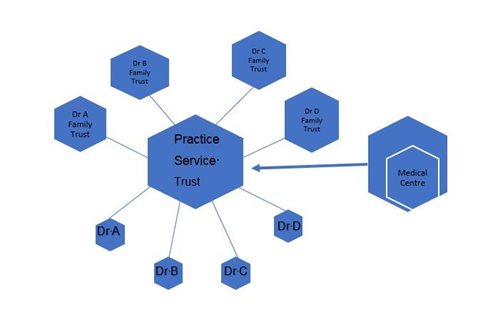

The above diagram represents the typical medical or dental practice structure which Murfett Legal has helped establish on numerous occasions. The structure can be used for general practitioners and specialists and allows a number of practitioners to benefit from a single service trust while retaining the independence of their own practices.

Under the structure, each practitioner operates his or her own practice and pays a service fee to the practice service trust (PST).

The PST provides the medical or dental rooms to each practitioner, all plant and equipment, reception and nursing services, administration, accounting, invoicing and payment services. The PST is commonly a discretionary trust but a unit trust or company may also be used.

Each practitioner practices either in his or her own name or through a practice company or trust and, on occasions, may operate through a partnership. Each practice is wholly responsible for its own medical or dental procedures and must separately obtain its own professional indemnity insurance. The assets of the PST may therefore be protected from any claims against of the practitioners.

The Australian Taxation Office and the Office of State Revenue (WA) are very familiar with this type of structure and as long as the payments by the practitioners to the PST are market related (see ATO ruling TR 2006/2) and the profit distributed to the family trusts by the PST is reasonable, the structure will not generally create any income tax or payroll tax issues.

Documentation

The number of legal documents required for the structure can be a little daunting but, often, the practitioners will already have some of the documents in place.

In broad terms the following legal documents are required:

- family trust deed for each practitioner;

- unit or discretionary trust deed for the PST;

- unitholders’ agreement for the PST (if it is a unit trust);

- practice management agreement between each practitioner and the PST;

- lease of the medical premises by the PST;

- employment agreements for each of the employees of the PST;

- financial leases for medical or dental equipment; and

- incorporation documents for corporate trustees.

It is not uncommon for the medical centre to be owned by another unit trust controlled by the practitioners. Again, we can assist with the drafting of the necessary documentation, including the unit trust deed, unitholders’ agreement and lease. The units in the property unit trust are often acquired by the self- managed superannuation funds of the practitioners.

Experience

Mike Frampton (Partner, Commercial, Taxation and Estate Planning) has over 30 years experience, working in both national and international accounting and legal firms, and over many years has developed a specialist knowledge and interest in the establishment of medical, dental and allied health services operating structures.

Mike has both taxation and commercial experience which allows him to explain the structure in a clear and concise manner and to draft all the necessary legal documents.

Murfett Legal are able to assist with all of the on-going legal issues which arise from time to time and, although the documents are designed to allow easy entry into and exit from the structure, we are able to assist with the addition or departure of practitioners and the sale or termination of the business.

The wider Murfett Legal team are also specialists in the following areas which can be relevant to practices and practitioners:

-

Property and Leasing

-

Employment and Workplace Relations

-

Contract preparation and review

-

Disputes, Litigation and Negotiation

-

Financing

-

Asset Structuring

-

Debt Collection

-

Intellectual Property

If you would like more information on any of our services, please contact us on +61 8 9388 3100 .

Download Brochure

Back to Previous Page